The Diplomat has published the analysis Yufan Huang and I did of the World Bank's data on outstanding debt in the 68 low income countries that are eligible to benefit from the G-20 Debt Service Suspension Initiative (DSSI).

Slicing and Dicing the Data

Here are some of the highlights.

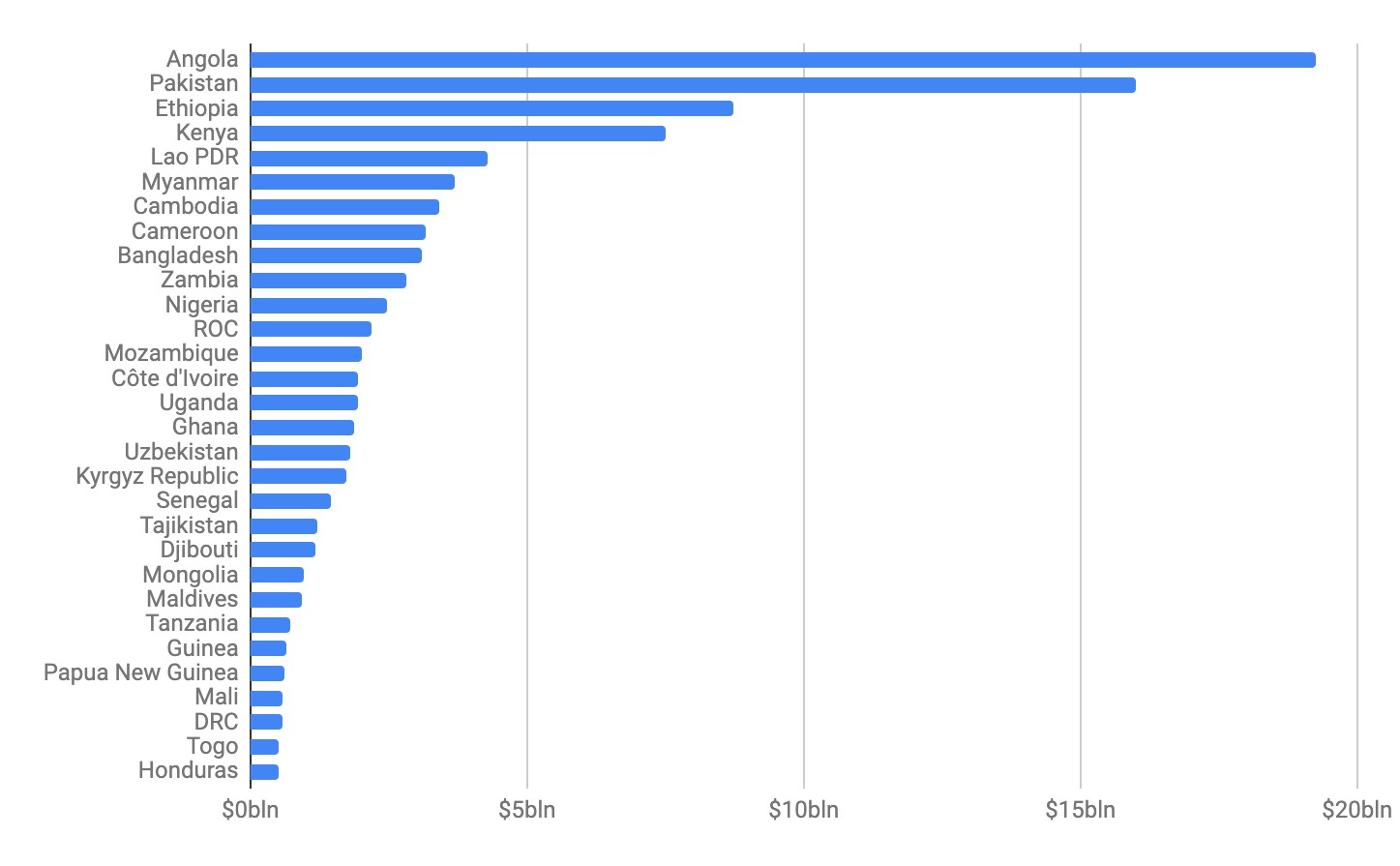

- The World Bank is still the largest creditor in poor countries (US$106 billion). But Chinese is very close (US$104 billion). In sub-Saharan Africa, China (US$62 billion) has outspent the World Bank (US$60 billion) as the biggest official lender to Africa’s poor countries. However, if Angola is removed from the data, the World Bank remains the largest creditor for low-income countries in Africa ($43 billion by China vs $59 billion by the World Bank).

- Creditors are owed about $43 billion in total debt service in 2020, and 30 percent of that is owed to China, more than to any other creditor.

- However, Angola owed China US$19 billion and Pakistan owed US$16 billion. These two made up 34% of the Chinese debt for all the 72 low-income countries. Half of all the debt service due to China this year is owed by just these two countries (US$6.45 billion).

We didn't note this in our piece for The Diplomat, but comparing our data at a granular level with the World Bank's figures, we found that, ironically, in some countries they were including debts actually owed to Taiwan as China. This was the case for part of the debt listed as due to "China" in Liberia, the Central African Republic, and all the debt listed as "China" in Burkina Faso between 2014 and 2018. Burkina Faso only established diplomatic relations with China in 2018 and so did not qualify for any official lending. Beijing is happy to claim that Taiwan is an integral part of China, but will loans from Taipei be honored as Chinese loans?